Methodology

I try to be as objective as possible and am open to switching to accumulating miles as I am a person who wants to stretch the dollar value of my expenses.Assumptions:

- I'm analysing this based on a long-term sustainable and realistic spending habit, i.e., not spend for the sake of spending or to buy that ultra expensive luxury/big ticket item. To further elaborate, this is done in the context of the average income earner (mass majority of us), not those super rich or those who spend frivolously.

- Anyway, for those who can afford to spend > $5 / month consistently, why even bother about rewards and cashback (which are insignificant to your expenditure)?

- I assume a round-trip from Singapore and miles accrual is in KrisFlyer.

- Hence I will use the latest SIA KrisFlyer Award Chart (effective from Jan 2019) to select the representative zones and the lowest number of miles needed for a round-trip redemption across Economy Saver and Advantage. Based on this post, taxes and fees have to be paid using non-miles.

I also scanned through the miles credit cards for a sensing of mile accrual rates, card annual fees and the T&Cs.

Analysis (Economy Flight)

Refer to this spreadsheet screenshot for the analysis (click to enlarge).

Meaning of the columns:

Amount to spend: I calculated the S$ to spend to get the min no. of miles required, assuming various accrual rates (i.e., 4 / 2 / 1.2 miles per $). Most of the cards give 1.2-1.4 miles per SGD spent locally, hence the realistic rate is 1.2 miles / $.

Cashback earned: I calculated the cashback that can be earned on the "Amount to Spend" assuming using the Maybank Barcelona Card which gives a base 1.6% rate for all eligible expenses. But of course higher rate is possible through careful optimisations such as by spending in categories with higher rates and/or utilising better cards.

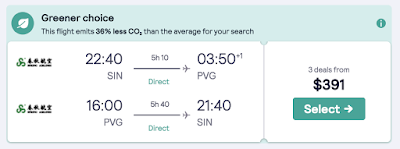

Lowest Ticket Price: I used SkyScanner to find the cheapest round-trip tickets (Economy/Budget direct flights only from any airline) using a future booking period of about 1 week in a non-peak season. Ticket price is used for gauging the dollar value of the miles earned. See screenshots below for evidence.

Amount Spending Period: Realistically, unless one has big ticket items to buy, the person has to spend "Amount to spend" over a few years. Based on annual expenses (chargeable to credit card) of S$20-25k.

Total Card Fees: Total annual fees paid throughout the "Amount Spending Period". I think it may be harder to waive off for miles cards (correct me if I'm wrong), hence a person has to pay the annual fees throughout the spending period. 1st year is usually waived but subsequent annual fee can range from $200-$500. Assume $200 for simplicity. Cashback cards usually have 2 years of waiver.

Miles Benefit: Final dollar value of the min no. of miles earned, for comparing with "Cashback Earned". Calculated as Lowest Ticket Price minus Total Card Fees.

Analysis for Business Class

At the request of some readers, I did an analysis for a long-distance flight in business class (first class as well if I have time in the future). I assume a 5% cashback rate here since it should be attainable given the large expenditure.

If we are able to earn 4 miles / $, then we'd only earn a cashback of $2,375.000 vs the miles benefit of $ 3,146.00 (Phillipines Airline) / S$5824 (SIA).

In this analysis for business class, miles will win hands-down if the rate is >= 4 miles/$, otherwise there is no clear-cut winner.

SIA Business Class costs S$6224 while Phillipines Airlines costs only S$3546. Base on this review, it seems that the quality of service is pretty decent. This comes as no surprise as quality of service by airlines should more or less be the same due to commoditisation of air transportation. A flight is just a flight, how different can it be? So what exactly are we paying for with the S$2700 difference? The branding of the airline so that we can post on Insta?

I'm uncertain which dollar value to tag to the earned miles, S$3546 or S$6224? Assuming all airlines price their tickets profitably, the cost of providing a business class seat may be much less than S$3546, and thus we as consumers are overpaying for it -- overpaying to a degree larger than we are for an economy seat. This then again begs the question of whether is it worth it?

I'm uncertain which dollar value to tag to the earned miles, S$3546 or S$6224? Assuming all airlines price their tickets profitably, the cost of providing a business class seat may be much less than S$3546, and thus we as consumers are overpaying for it -- overpaying to a degree larger than we are for an economy seat. This then again begs the question of whether is it worth it?

Conclusion

For general/daily/long-term spending, cashback appear to be better. Thus I will stick to cashback for the simplicity of it and the fact that miles don't offer much more benefits (assuming a realistic rate of 1.2 miles / $ accrual).

Miles would be better for big ticket item expenditure when one can accrue at >= 4 miles/$, and that's when the earned miles can be redeemed for long-distance / biz class / suites flights. It takes careful planning to spend the right amount of money on the right cards. The spending period should be as short as possible to avoid card fees. I will consider using miles if I have big-ticket items, probably for my upcoming house renovation.

The downside of miles is that it takes much time and patience to earn, manage and redeem the miles, let alone navigating the complicated ever-changing terms and conditions. The value of cashback is immediately realised at the end of each month while the value of miles is only at the point of redemption. Til then, you're subjected to significant risk as the reward and miles redemption T&Cs may change any time at the banks/airline's discretion.

Also, with actual spending terms such as these, it is challenging to get more than 1.2-1.4 mile / $ on average in a sustainable manner (not spend for the sake of spending):

1.2 miles per S$1 locally, 4 miles overseas & on select airlines

• 4 miles per S$1 on select entertainment (Netflix, Spotify & more)

• 8 miles per S$1 on select travel & accommodations bookings (Agoda, AirBnB & more)

1.2 miles per S$1 locally, 2 miles overseas, 3 miles for online travel bookings

1.4 miles per S$1 local spend, 2.4 miles overseas, 10 miles at major airlines & airports

Earn up to 4.4mi/S$1 on overseas dining, shopping & accommodation, 3mi on Klook

1.2 miles per S$1 local spend, 2 miles overseas

• Promotions: Earn 1.5 miles per S$1 local spend w/ min. S$3k monthly spend

• Option One: 26,500 miles w/ 1st annual fee payment & S$9k spend within 3 months

• Option Two: 6,400 miles w/ 1st annual fee payment & S$3k spend within 3 months

1.4 miles per S$1 local spend, 3 miles overseas (S$2,000 min spend)

What many miles proponents don't tell you is that you'd be spending A LOT of time "hacking miles". There may be frustration, constant monitoring every transaction to ensure they translate to miles, etc. Just look at this entire list https://milelion.com/credit-cards/guide/, imagine you'd have to comb through the T&Cs (from airlines and banks) and apply for the appropriate cards for your spending.

Ultimately you'd probably have to juggle with multiple cards, read the fineprints very carefully and possibly spend significant time talking to the respective customer service to claim missing miles or to clarify which expenditure is eligible.

Referring to this post and this post, we can use credit card thru GrabPay to earn miles, but there are severe restrictions on how much you can earn. Imagine once you have started earning miles at say 10x points or 4 mpd, halfway thru, the T&Cs change, and viola, what will happen to your miles earned so far? You may not be able to hit your target soon enough to redeem for that dream vacation.

Once you're in the miles game, you're in it for the long-haul, subjected to the whims of the banks and airlines which can change their T&Cs at their own discretions.

*Latest Update* Base on the terms: https://www.citibank.com.sg/global_docs/pdf/Citi_Rewards_Card_10X_Rewards_Promotion_Terms_and_Conditions.pdf

Mobile wallet topups have been excluded.

What do you think?

Miles would be better for big ticket item expenditure when one can accrue at >= 4 miles/$, and that's when the earned miles can be redeemed for long-distance / biz class / suites flights. It takes careful planning to spend the right amount of money on the right cards. The spending period should be as short as possible to avoid card fees. I will consider using miles if I have big-ticket items, probably for my upcoming house renovation.

The downside of miles is that it takes much time and patience to earn, manage and redeem the miles, let alone navigating the complicated ever-changing terms and conditions. The value of cashback is immediately realised at the end of each month while the value of miles is only at the point of redemption. Til then, you're subjected to significant risk as the reward and miles redemption T&Cs may change any time at the banks/airline's discretion.

Also, with actual spending terms such as these, it is challenging to get more than 1.2-1.4 mile / $ on average in a sustainable manner (not spend for the sake of spending):

1.2 miles per S$1 locally, 4 miles overseas & on select airlines

• 4 miles per S$1 on select entertainment (Netflix, Spotify & more)

• 8 miles per S$1 on select travel & accommodations bookings (Agoda, AirBnB & more)

1.2 miles per S$1 locally, 2 miles overseas, 3 miles for online travel bookings

1.4 miles per S$1 local spend, 2.4 miles overseas, 10 miles at major airlines & airports

Earn up to 4.4mi/S$1 on overseas dining, shopping & accommodation, 3mi on Klook

1.2 miles per S$1 local spend, 2 miles overseas

• Promotions: Earn 1.5 miles per S$1 local spend w/ min. S$3k monthly spend

• Option One: 26,500 miles w/ 1st annual fee payment & S$9k spend within 3 months

• Option Two: 6,400 miles w/ 1st annual fee payment & S$3k spend within 3 months

1.4 miles per S$1 local spend, 3 miles overseas (S$2,000 min spend)

What many miles proponents don't tell you is that you'd be spending A LOT of time "hacking miles". There may be frustration, constant monitoring every transaction to ensure they translate to miles, etc. Just look at this entire list https://milelion.com/credit-cards/guide/, imagine you'd have to comb through the T&Cs (from airlines and banks) and apply for the appropriate cards for your spending.

Ultimately you'd probably have to juggle with multiple cards, read the fineprints very carefully and possibly spend significant time talking to the respective customer service to claim missing miles or to clarify which expenditure is eligible.

Referring to this post and this post, we can use credit card thru GrabPay to earn miles, but there are severe restrictions on how much you can earn. Imagine once you have started earning miles at say 10x points or 4 mpd, halfway thru, the T&Cs change, and viola, what will happen to your miles earned so far? You may not be able to hit your target soon enough to redeem for that dream vacation.

Once you're in the miles game, you're in it for the long-haul, subjected to the whims of the banks and airlines which can change their T&Cs at their own discretions.

*Latest Update* Base on the terms: https://www.citibank.com.sg/global_docs/pdf/Citi_Rewards_Card_10X_Rewards_Promotion_Terms_and_Conditions.pdf

Mobile wallet topups have been excluded.

What do you think?

Lowest Ticket Prices

I have been a great fan of Scoot for its very cheap tickets during promotional periods, to Europe (Athens/Berlin), to SEA, to China, etc. So I think their ticket prices may even be lower than those I found on SkyScanner for this analysis.

I don't buy flight addons (e.g. meals, extra leg space, seat selection, insurance, WiFi, etc.) even though I'm a tall person of ~1.8m and for certain plane models, the seats are actually quite spacious.

North China (Shanghai)

Malaysia (KL)

Malaysia (KL)

Thailand (Bangkok Alternate Airport)

Thailand (Bangkok main airport)

US (San Francisco) Direct Flight

US (SF) cheaper but with 1 stop and still reasonable duration

US (SF) cheaper with 1 stop and reasonable duration