I share deep insights in investing and finance and my journey towards a multi-million-dollar net worth for early retirement.

Monday, December 31, 2018

Net worth review 2018

As the year comes to an end, I have reviewed my net worth and reflected on my life and investing journey. My short investing journey began in 2016 with < 10k vested and in this year I have taken a much more serious tone towards portfolio management given the increased amount vested. I have learned much indeed in this turbulent market.

My net worth details : https://my-radical-thoughts.blogspot.com/p/blog-page.html

Portfolio details: https://my-radical-thoughts.blogspot.com/p/my-portfolio.html

Everything has been dropping this year: cryptos, COE, stocks, bonds. The unexpected COE downtrend has affected my car resale value.

I have screened more than 300 stocks in SGX this year and uncovered gems several of which I have done more in-depth studies and vested in them when their prices came down from the peaks.

I intend to hold for at least 5 years and hopefully I will be substantially rewarded.

Net worth comes from an above-average job, abnormally high savings rate and some other things.

Tuesday, December 11, 2018

High-level financial analysis of H-Trusts in SGX

In this article, I will look at the hospitality trusts (a.k.a. H-Trust) listed in SGX. Currently, there are 6 such H-Trusts, namely:

Even though Ascott has been growing its revenue strongly, its net income has been whipsawing over the years. The net income for CDL dipped before recovering lately.

1. Ascendas

2. CDL

3. Far East

4. Frasers

5. Ascott

6. OUE

I decided to do this exercise because they piqued my interest and I couldn't find any good comparison on the net.

Take note I will only look at them from a high-level point of view, as I have no time to dig into the details for each of them.

Ascott and CDL have been around for more than 10 years, so they have more data for us to make an accurate judgment, while the others are still relatively new. I assume all the data, taken from MorningStar and Dividends.sg, is correct (or at least roughly correct).

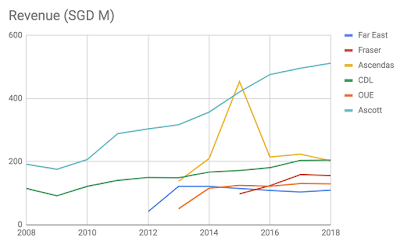

Revenue

Ascott has been growing its revenue very well (~10% CARG from 2008-2018), while CDL is a much slower grower. For the rest, the revenue is quite flattish except for Ascendas and Fraser which showed some slight growth over the past few years. I don't think it's meaningful to calculate the CARG for the others as the timeframe is quite short.

Net Income

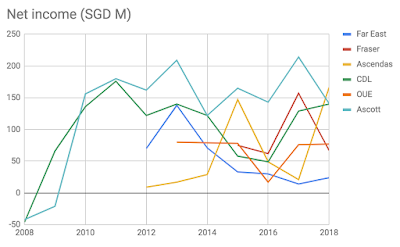

The net income chart shows a very different picture.

Even though Ascott has been growing its revenue strongly, its net income has been whipsawing over the years. The net income for CDL dipped before recovering lately.

During the GFC, the net income for CDL and Ascott went negative but quickly recovered.

The net income for Far East is on a downtrend while the net income for the rest is whipsawing.

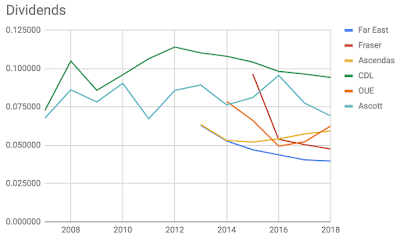

Dividends (DPU / S$ cent per share)

Now let us look at the dividends which is what many of us care about for investing in Trusts and REITs. As expected, the dividends correlate with the net incomes.

All show a downward trend except for Ascendas and Ascott, and a recovery is not in sight.

Only Ascendas shows an uptrend but the timeframe is too short to make any solid conclusion.

Rights Issues / Scrip Dividends / Private Placements

| Far East | Fraser | Ascendas | CDL | OUE | Ascott | |

| 2018 | 0.039700 | 0.047613 | 0.059400 | 0.094300 | 0.062600 | 0.069220 |

| 2017 | 0.040500 | 0.050458 | 0.057400 | 0.096500 | 0.052300 | 0.077480 |

| 2016 | 0.043800 | 0.053853 | 0.054200 | 0.098200 | 0.049500 | 0.095630 |

| 2015 | 0.047100 | 0.096645 | 0.052125 | 0.104300 | 0.066300 | 0.081110 |

| 2014 | 0.052800 | 0.053201 | 0.108100 | 0.078600 | 0.076350 | |

| 2013 | 0.063100 | 0.063608 | 0.110300 | 0.089360 | ||

| 2012 | 0.114100 | 0.085800 | ||||

| 2011 | 0.106500 | 0.067360 | ||||

| 2010 | 0.096000 | 0.090400 | ||||

| 2009 | 0.085900 | 0.078300 | ||||

| 2008 | 0.105000 | 0.086200 | ||||

| 2007 | 0.072600 | 0.067700 |

Above is the dividends table from which I plotted the dividends chart. Cells highlighted in pale orange mean there was at least one share dilution action in that year.

Ascott has the most number of share dilution action while Far East has none.

Price Action

I look at the price action to have a sense of which Trust gives the biggest capital gain since mid-2015 (around the time the newest Trust, Fraser, was listed).

Ascendas (Q1P dark purple line) gave the biggest gain and the rest are far from it.

Conclusion

To investigate further, one should look at other metrics such as the quality of assets, gearing ratio, RevPAR, and ADR.

However, based solely on the data above, if I were to make a choice, Ascendas does seem to be the overall winner here.

CDL and Ascott have lacklustre performance over the past 10 years.

Far East and OUE have poor performance as well in the past 5 years.

Welcome any feedback and opinions.

Saturday, December 8, 2018

REITS and Trusts to avoid

Investing in REITs is rewarding because of the juicy dividends. However, certain REITs have higher risks than others.

The market is forward-looking and very efficient in pricing equities and hence those REITs with yield > 7% usually have some inherent risks involved. Do not ever blindly invest in REITs with high dividends. The recent plunges in Asian Pay TV and others serve as a wake-up call / reminder to many of us.

Here, I will present a non-exhaustive list of REITs and Trusts that I will avoid. You may choose to disagree. I welcome any feedback. Typically once I see red flags such as short track record, consistently dropping DPU for a few years, unusually high gearing or concentration risks (e.g. tenant, geographical), I will avoid.

The market is pricing the REITS below with yields of between 6 and 10%, but I will not take the risk.

*Update*: I look at the business fundamentals only. Even if the NAV is very attractive or the price has reached 52-week low, I would not touch them until the fundamental improve. After all, the fundamental determine whether the dividend is sustainable.

For the following, I will avoid for now but I will continue to monitor their track record and even may start to invest in them once the red flags are gone.

The market is forward-looking and very efficient in pricing equities and hence those REITs with yield > 7% usually have some inherent risks involved. Do not ever blindly invest in REITs with high dividends. The recent plunges in Asian Pay TV and others serve as a wake-up call / reminder to many of us.

Here, I will present a non-exhaustive list of REITs and Trusts that I will avoid. You may choose to disagree. I welcome any feedback. Typically once I see red flags such as short track record, consistently dropping DPU for a few years, unusually high gearing or concentration risks (e.g. tenant, geographical), I will avoid.

The market is pricing the REITS below with yields of between 6 and 10%, but I will not take the risk.

*Update*: I look at the business fundamentals only. Even if the NAV is very attractive or the price has reached 52-week low, I would not touch them until the fundamental improve. After all, the fundamental determine whether the dividend is sustainable.

| REIT | Type | Pros & Cons |

| Accordia Golf Trust | Country Club | - Not worth investing |

| Asian Pay TV | Retail | - Poor business fundamentals - Cable TV is Sunset industry (?) |

| Cache logistics | Industrial / Logistics | - Declining earnings - Increasing vacancy |

| Lippo | Retail | Affected by Indo tax. Higher gearing > 45%. DPU affected. |

| Sabana REIT | Industrial | - DPU dropping over past few years |

| Sassuer REIT | Retail | - High concentration risk in China - S-chip stigma - short WALE |

| SoilbuildBiz | Industrial / Logistics | - Declining growth - High gearing |

| StarhillGbl Reit | Retail (12% Commercial) | - DPU dropping for past few years (2018) - Most of revenue from Wisma Atria and Ngee Ann (>60%) - Retail malls target mid to high-end consumers |

For the following, I will avoid for now but I will continue to monitor their track record and even may start to invest in them once the red flags are gone.

| AIMSAMP Cap Reit | Industrial / Logistics | - ascendas REIT seem better - DPU drops from 2016-2018 - revenue growth is flattish |

| BHG Retail Reit | Retail | - portfolio of just five properties in China is very concentrated. - short history in the public eye, and the true long-term resilience of the portfolio cannot be accurately reflected over just a three-year history as a public entity. - the five properties have land use terms expiring between 2042 and 2047. This is only less than thirty years away. Therefore, the REIT may have to fork out additional capital when the time comes to renew the land leases. - manager yet to take its share of distribution http://aspire.sharesinv.com/35947/si-research-should-investors-pay-attention-to-bhg-retail-reit/ |

| CromwellReit EUR | - too new | |

| Dasin Retail | Retail | - wait for a few more years to observe - Concentration risks: 4 malls in Zhongshan City of China’s Guangdong province. (China’s Pearl River Delta) - S-chip stigma Pros: - good growth in 1st year. - gearing only 30% -- room for acquisition |

| EC World REIT | Industrial / Logistics | -Risk: master leases expiring in 2020 - dividend sustainable? - income in RMB but div in SGD https://www.fool.sg/2018/06/20/ec-world-real-estate-investment-trust-the-bear-case/ https://www.theedgesingapore.com/article/5-reasons-not-participate-ec-world-reit%E2%80%99s-ipo http://ernest15percent.com/index.php/2018/07/02/ec-world-reit-potential-strong-growth-ahead-29-jun-18/ |

| IREIT Global | Commercial | - All 5 office properties concentrated in Germany - 51% of gross rental income from 1 tenant (GMG) - 32% from 1 tenant (Deutsche Rentenversicherung Bund) - High leverage (40%) - Lots of short-term debt Average Weighted Debt Maturity: 1.4 years - WALE 3-5 years only - Forex risk (EUR vs SGD) (hedged) Pros: - Avg 98% occupancy - 88% fixed rate debts - All freehold properties |

| Mapletree NAC | Retail | -Festival walk contributes 63% to Net income (concentration risk) - High gearing 40% Pros: - P/B < 1 |

Tuesday, October 16, 2018

Optimise living expenses Part 1

I am a true-blue minimalist in that I only buy things that are necessary. However, I do own a car 'cos I am tired of taking public transport to/fro my home in one of the most populous areas in Singapore. Another reason is I can afford to do so :) My annual income can buy an entry level car with COE included. You can read about it here

Let me share with you how I optimise my expenses in various areas without sacrificing much qualify of life. Sometimes I'd only give a broad guidance and won't go into the details.

Entertainment:

Let me share with you how I optimise my expenses in various areas without sacrificing much qualify of life. Sometimes I'd only give a broad guidance and won't go into the details.

Entertainment:

- I used to buy HSBC movie cards (for HSBC card owners only) which are just stored-value cards that allow purchasing of a fixed number of tickets online/offline at a discounted price. I'm not sure whether GV still offers it.

- I stopped buying those cards until I realised I can watch on weekdays at the lowest price. A typical 2D movie costs $6.50-$7.50 at GV per pax on weekdays. On weekends it can go up to $13! Some credit cards offer a slight discount and you can even get cashback on ShopBack.

- You can take up the free GV membership which offers perks and 1-for-1 tickets during your birthday month.

- Don't buy the over-priced and low-quality food at the cinema.

- To take it further, you can go for the cheapest Netflix subscription at only $10+/month but the latest movies won't be available. You can get a free 2-month Netflix subscription by signing up to be a LiveUp member via Lazada, etc.

- KTV: Well you can go to Civil Service Club, Teoheng and those not-as-branded ones. The prices should be cheap during off-peak hours. However, do note that CSC might not have the latest songs.

- Take advantage of corporate scheme discounts and reimbursements.

- You can subscribe to $20/month SIM-only plans -- if you don't want a new phone with a 2-year contract. A SIM-only plan is quite decent given the price. For example, Singtel offers 3 GB (no talktime, no SMS, no caller ID) for $20. You can add on 200-min talktime and Caller ID for only $5 / month each. I don't think anyone needs SMS. With a 12-month contract, the same SIM-only plan offers more perks: 5GB, 150 min and 500 SMS.

- Alternatively, you can get a new phone with contract and sell the phone at slightly below retail price to earn about $100-$200 one-off depending on the phone and selling price. However, this comes with a risk of not being able to sell the phone.

- You can also try cheaper telcos such as zero1 and Circles.Life with better perks and lower prices. They have no physical shops to save on operating costs. However, be prepared the customer service may take a long time to reply you. Well after all they have to cut costs somewhere to pass on the savings to you right? Both virtual telcos lease infra from M1 so the coverage is the same as M1's. But of course, SingTel offers the widest coverage with free ST WiFi at many locations.

- I personally have been a long-time SingTel customer. After my contract ended, I switched to SIM-only $20 + $5 for 200-min talktime. I don't have caller ID so I risk picking up overseas spam calls. Now I am contemplating swapping talktime for caller ID. I rather pay $0.16 / min (as-charged) for talktime as I usually use data to call people. I hardly use SMS and it costs only $0.05 / SMS anyway.

- Try to buy during sales periods such as Black Friday, Cyber Monday when steep discounts are offered. However, the best policy is to curb the urge to buy. Ask yourself whether it is truly necessary. I have lived pretty well with just a phone and laptop for many years.

- Don't chase the latest trends. Usually a gadget can last for pretty long, at least 5 years in my experience. So far my external harddisk and laptop have no problems. For a phone you can change the battery and it will be like-new again.

- I personally use iPhone as I prefer paying a premium for quality phones (compared to Xiaomi, etc.). The screen size is also just nice for my jeans pocket. Ladies usually prefer the Plus version 'cos they put in their bags instead of pockets. It has been 2 years now and I intend to change the battery to use it for a few more years.

Tuesday, August 14, 2018

Reflection on owning a car in the most expensive city

Previous articles:

I have shared some tips both car and non-car related on my blog:

Minimising car expenses

My Expenses

I also shared my rationale for buying a car:

Saving money on car ownership in Singapore

I am quite frugal excluding the owning of a car.

Having a car is great. It gives you freedom and a sense of control if you like driving.

It also allows you to explore remote and unique/interesting places.

feel free to ask me more questions on money-saving tips. I consider myself an expert in saving money and exploiting systems heh, still while enjoying life.

Last time I also thought that I could taxi everywhere which is still cheaper than owning a car. But over time after I built up my savings and grew discontented with public transport, I decided to buy one.

If you ask me whether I regretted buying, I'd say partially, due to the COE dropped quite a fair bit, causing more depreciation to my car. Other than that, I'm very satisfied and I'd say my quality of life has improved. Barring accidents on the road, and rare traffic congestions, the car has greatly reduced my commuting time to/fro work by 30-50% depending on the traffic condition. This is much better than taking MRT and buses, having to stand and squeeze with others.

The best time to buy a car is probably during a recession, like stocks, lol.

Once you own a car, you wouldn't feel like going back to taxi/public transport, even despite the high cost of ownership.

Not to mention having a car helps in getting you the girl.

Saturday, July 28, 2018

SRS account 34% return in 6 months

Previously I have explained why I contributed to my SRS account here.

I have been wanting to do this update but couldn't find the time to do it.

Since then I have done trading with my SRS fund and obtained superior returns thus far.

As SRS account earns peanut interest, I am compelled to invest/trade.

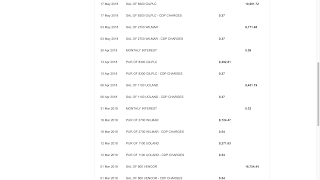

From the period of Jan to Jun 2018, I have grown my SRS from 15.3k to 20.5k. A whopping 34% return in 6 months!

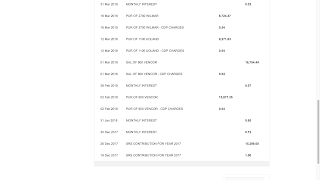

Below screenshots show my transaction history. Thus far, I must say I have been very lucky and have picked the correct stocks to trade. All the trades have been 100% profitable. All of them have weathered the fearful trade war and rising interest rates period.

The trades all involved blue-chips. Who says you cannot earn from blue-chips :) ?

They involved various strategies such as dividend play, speculation play, etc. It takes a lot of patience and observation of the market to be able to achieve such a feat.

Hope this inspires people out there to grow their retirement nest.

Some tips:

I have been wanting to do this update but couldn't find the time to do it.

Since then I have done trading with my SRS fund and obtained superior returns thus far.

As SRS account earns peanut interest, I am compelled to invest/trade.

From the period of Jan to Jun 2018, I have grown my SRS from 15.3k to 20.5k. A whopping 34% return in 6 months!

Below screenshots show my transaction history. Thus far, I must say I have been very lucky and have picked the correct stocks to trade. All the trades have been 100% profitable. All of them have weathered the fearful trade war and rising interest rates period.

The trades all involved blue-chips. Who says you cannot earn from blue-chips :) ?

They involved various strategies such as dividend play, speculation play, etc. It takes a lot of patience and observation of the market to be able to achieve such a feat.

Hope this inspires people out there to grow their retirement nest.

Some tips:

- Be very selective.

- Stay away from what you do not understand.

- Do not chase high prices.

- Be patient.

I will regularly release stock tips, so please follow my blog and click the "Like" button at the top.

Feel free to ask any questions below.

Feel free to ask any questions below.

Saturday, June 30, 2018

Use Chope and Quandoo for FREE food and CASH

This is more of a lifestyle article. I frequently use Chope and Quandoo which are the 2 biggest restaurant reservation apps here.

Recently I have redeemed 1000 chope-dollars (points) for a $30 dining voucher sent via email. The process was instant and fuss-free.

My partner and I used it to order a delicious platter at some restaurant by the sea on a romantic night.

I have also often redeemed 1000 Quandoo points for $15 and have gotten more than $100 in CASH so far just by visiting restaurants. No extra effort. It works by crediting the cash via bank transfer.

Here's the deal: every visit to a restaurant earns you 100 Chope or Quandoo points which are worth $3 and $1.50 respectively. If you use any promo code, you may even get more! If you write a simple review on Quandoo, you get additional 25 points. Recently I got 400 points easily just by doing a Chope survey.

Start using Chope and Quandoo today!

Recently I have redeemed 1000 chope-dollars (points) for a $30 dining voucher sent via email. The process was instant and fuss-free.

|

| Details masked out |

My partner and I used it to order a delicious platter at some restaurant by the sea on a romantic night.

Huge Meat Platter: Juicy ribs, Spicy curry, Toasty bread, Crispy chicken wings, and tender sausages

I have also often redeemed 1000 Quandoo points for $15 and have gotten more than $100 in CASH so far just by visiting restaurants. No extra effort. It works by crediting the cash via bank transfer.

|

| One of many credited transactions. |

Here's the deal: every visit to a restaurant earns you 100 Chope or Quandoo points which are worth $3 and $1.50 respectively. If you use any promo code, you may even get more! If you write a simple review on Quandoo, you get additional 25 points. Recently I got 400 points easily just by doing a Chope survey.

Start using Chope and Quandoo today!

Get the app now! iOS: http://bit.ly/QniOS //// Android: http://bit.ly/QnAndroid

Thursday, March 1, 2018

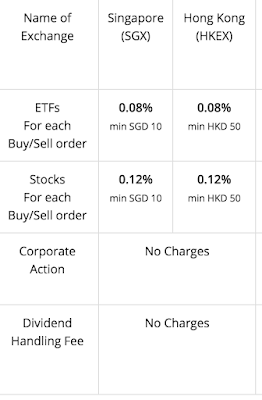

Best brokers to buy/sell stocks

DBS Vicker Cash Upfront

Pros:

- Stocks you buy will be credited to the CDP by T+3. Currently there is a promo as shown until the end of June 2018.

Cons:

- Inconvenient: Have to login through Internet Banking website. Authenticate 2FA twice.

- Order type: No stop loss.

FSM One

Buy using Vicker and sell using FSM! Beat Stan Chart's 0.20% hands down with CDP protection! However, Stan chart offers stop loss order type which Vickers and FSM One do not.

They have revamped their offering and they allow selling of shares from CDP for 0.12% only.

Buying of shares is currently only with cash and will place shares under their custody. CPF IS is not supported.

I clarified the above with FSM's customer support.

Buying of stocks using CPF IS is still expensive at 0.28% (DBS) or 0.275% (OCBC).

Conclusion

Buy using Vicker and sell using FSM! Beat Stan Chart's 0.20% hands down with CDP protection! However, Stan chart offers stop loss order type which Vickers and FSM One do not.

Saturday, February 24, 2018

Jan Expenses

I'm always too lazy to tabulate my expenses, but this time round I had some time to do it.

These include petrol, car washes, regular polishing package (instalment) and insurance. The insurance is on the high side as my license is quite new.

The parking is for outdoor season parking at home and at work as well as adhoc parking paid using the Parking@SG app.

Cash card cost is for adhoc parking outside (estimated).

Looking at my expenses, it is quite hard to reduce further. Food is easily the largest category (non-car) but it is hard to reduce without resorting to eating economical rice or sandwich every day (although I do eat them quite often).

When I move out and have my own housing, the expenses will go up due to utilities. I intend to use fans to save $.

| Food | 180 |

| Meals at home (est.) | 200 |

| Entertainment | 14.5 |

| Transport | 50.25 |

| Gadgets | 1.15 |

| Housing | 69.5 |

| Property tax (est.) | 10 |

| Total | 525.4 |

I didn;t include insurance costs this time. Anyway for non-saving insurance, my cash expenses are only < $80 for AVIVA term and PruShield + Extra -- more than enough to cover any terminal illness.

Food & Groceries

This is the amount spent on meals outside on working and non-working days, including restaurants. I hardly eat at restaurants nowadays, so I just go have a drink and chill. I sometimes go coffeeshops to chill as well -- get a cheap beer or tea like a true "uncle". I hate noisy places so I don't go to crowded bars, clubs, etc. You can hardly talk over there. I enjoy quality conversations as a form of bonding rather than superficial enjoyment.

I regularly buy groceries such as milk and snacks. I always buy soya milk (with the 2 cartons for $3.xx promo).

I regularly buy groceries such as milk and snacks. I always buy soya milk (with the 2 cartons for $3.xx promo).

Meals at home

This is just pure estimation. My mother does all the cooking and she often cooks salmon and other good stuff, so I put it at a higher estimate. Sometimes she gets salmon fish head for free or at a very low price and it's yummy when pan-fried!

I don't pay her directly for this expense but it is paid as the monthly allowance.

I don't pay her directly for this expense but it is paid as the monthly allowance.

Entertainment

This is for one movie on Tues at GV for 2 pax. $6.50/pax + $1.50 for booking fee.

Transport

One ez-link topup with a convenience fee of $0.25. This happens once every few months as I sometimes take bus from my workplace to other places for lunch.

Gadgets

One 2m iPhone charging cable bought from Qoo10. Yes only $1.xx including delivery by mail. Better than Challenger which sells for $5. The factory price is probably only $0.10 haha .. imagine the margin!

Housing & Property tax

Help my mum pay for the town council fee and property tax as part of the allowance.

Car-related expenses

| Car | 432.44 |

| Parking | 86.88 |

| Cash Card | 20 |

| Parking (work) | 110 |

| total | 649.32 |

These include petrol, car washes, regular polishing package (instalment) and insurance. The insurance is on the high side as my license is quite new.

The parking is for outdoor season parking at home and at work as well as adhoc parking paid using the Parking@SG app.

Cash card cost is for adhoc parking outside (estimated).

Looking at my expenses, it is quite hard to reduce further. Food is easily the largest category (non-car) but it is hard to reduce without resorting to eating economical rice or sandwich every day (although I do eat them quite often).

When I move out and have my own housing, the expenses will go up due to utilities. I intend to use fans to save $.

Saturday, February 17, 2018

Why I do not buy festive goodies

I have become more and more frugal over the years since the days of splurging on excesses that I did not really need. In fact on hindsight I regretted my financial choices and wondered what's the point of spending money on moments that do not last. For example, I had once splurged $80 on a crab buffet -- it was only enjoyable at that moment. I'm pretty sure I couldn't and didn't consume $80 worth of crabs and hence I would be better off achieving the same economic utility or satisfaction somewhere else with a much smaller budget. Satisfaction only increases marginally on increasing expenditure beyond a certain point, so why not save most of the money and spend somewhere else?

Sometimes I do spend slightly more depending on the situation, for e.g., outing with strangers and "important people", as I do not want to convey an impression of stinginess. But when I'm with familiar friends and family, I always go for the cheapest. I find that most often, I can go with the cheapest options without compromising much on quality, if at all.

It's the same with over-priced festive goodies. It's Chinese New Year again and I did not buy a single goodie although my family did. I wouldn't buy even if they didn't. Festive goodies used to be my favorites but not anymore as I realised I could derive the same satisfaction with a smaller budget. As I have reached a third of my expected lifespan, I need to start taking care of my health by avoiding such foods.

I also did not celebrate Valentines' Day as I think it is really just another ordinary day. If you wish, any day could be Valentines' Day. It seems to me it is a trap designed to rip off consumers with over-priced flowers and goodies.

Sometimes I do spend slightly more depending on the situation, for e.g., outing with strangers and "important people", as I do not want to convey an impression of stinginess. But when I'm with familiar friends and family, I always go for the cheapest. I find that most often, I can go with the cheapest options without compromising much on quality, if at all.

It's the same with over-priced festive goodies. It's Chinese New Year again and I did not buy a single goodie although my family did. I wouldn't buy even if they didn't. Festive goodies used to be my favorites but not anymore as I realised I could derive the same satisfaction with a smaller budget. As I have reached a third of my expected lifespan, I need to start taking care of my health by avoiding such foods.

I also did not celebrate Valentines' Day as I think it is really just another ordinary day. If you wish, any day could be Valentines' Day. It seems to me it is a trap designed to rip off consumers with over-priced flowers and goodies.

How to save on income taxes

My philosophy of managing wealth is to maximise the income and investment returns while aggressively cutting costs. Always go for the cheapest while not compromising on quality if possible. In this case, taxes contribute to nation building which has little direct visible impact on myself.

Parent Relief

SRS Relief

You can contribute to SRS and do investment for the long-term while saving taxes. SRS contribution cannot be backdated, i.e., contribute beyond the limit now and claim back the relief retroactively. The max contribution for Singaporean Citizens and PR is $15,300.

CPF Cash Top up Relief

Instead of giving allowance to your parents as cash, you can consider topping up the SA (below 55 yrs old) or RA (above 55 yrs old). You can get tax relief for up to $7,000 contributed. There is a way to do this sustainably I can think of but I shan't share it here.

This page is your best friend on how to reduce taxes: https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Deductions-for-Individuals--Reliefs--Expenses--Donations-/#title7

Parent Relief

The most common I can think of is the Parent Relief since many of us still stay with parents here in Singapore. Yes as long as your parents are no longer working (< $4,000 annual income) and staying with you, you can claim relief for it. See the page for the exact criteria. You'd have to manually submit this claim in your annual income assessment as the government won't know automatically you fulfill the criteria or not (although technically they have the means to do it).

I realised it only after a few years of working which fortunately wasn't too late as I was able to retro-claim the relief up to a few years back (i.e. IRAS giving you back your $$, rare isn't it?)

SRS Relief

You can contribute to SRS and do investment for the long-term while saving taxes. SRS contribution cannot be backdated, i.e., contribute beyond the limit now and claim back the relief retroactively. The max contribution for Singaporean Citizens and PR is $15,300.

CPF Cash Top up Relief

Instead of giving allowance to your parents as cash, you can consider topping up the SA (below 55 yrs old) or RA (above 55 yrs old). You can get tax relief for up to $7,000 contributed. There is a way to do this sustainably I can think of but I shan't share it here.

Friday, February 16, 2018

Why I am forced to buy Unit Trusts

As a Singaporean, a large part of our cash (about 37%) from income will be locked away in the CPF.

Most of the money in the Ordinary Account (OA) will be earning a guaranteed and meagre 2.5% interest rate which barely beats inflation. The first $60,000 in aggregate across your CPF sub accounts also earns an extra 1%.

The first $20,000 in your OA and $40,000 in your Special Account (SA) are NOT investible. (Source: https://www.cpf.gov.sg/Members/Schemes/schemes/optimising-my-cpf/cpf-investment-schemes )

According to https://www.cpf.gov.sg/Assets/members/Documents/CPFISInvestmentProducts.pdf , CPF-OA money can be used to invest in :

Of course, to beat the 2.5%, I would like to invest in instruments with the highest potential gains. Only equities can yield the highest returns (which come along with the highest risk as well).

We all know about the high management fees of Unit Trusts. In fact, on average, the total expense ratio for many high-performing Unit Trusts is about 1.7% (based on my observation from Fundsupermart's fund selector) which eats into your returns.

Even though there are Unit Trusts with high returns of at least 10% per annum, I want to avoid them due to the high expense ratio.

Unfortunately, the 4 ETFs are not exactly good alternatives since they will probably yield less returns than Unit Trusts even after taking into account the high expenses, based on the ETFs' historical performance.

In summary, constrained by CPF policies and the lack of better alternatives, I have to reluctantly put 65% of the investible amount in Unit Trusts.

I also invest in Unit Trusts using cash ($300 / month) via Maybank as I want to get the 3% p.a. interest rate under its SaveUp programme. Again, I am compelled to do so as I do not have any better way to fulfill the SaveUp programme criteria. Much of the criteria involve taking up loans (i.e. spending more money rather than saving)

Many platforms offer some form of regular investment plan that I have since terminated and will avoid for now as I prefer to have more control over the price to buy and sell at (not 100% control though).

Downside

The biggest disadvantages of unit trusts are they don't offer limit orders and the settlement is extremely slow compared to instantaneous buying and selling over exchanges.

Avoiding more fees

I use POEMS as there is no sale charge, no platform fee and no switching cost. It is also a CPFIS administrator meaning you won't incur the $2 / counter / quarter fee from the CPFIS agent bank. FSMOne is also a good alternative with a better user interface and same offering as POEMS.

CPF-SA

I do not invest the SA money as I consider it a 30-year almost-risk-free high-yield "bond". The only risk comes from any CPF policy changes and economy instability.

Anyway there's nothing good to invest in. The only way to beat a guaranteed 4% is to buy unit trusts as CPF-SA cannot be used for stocks and ETFs. There is a limited set of unit trusts for CPF-SA that is different from that for CPF-OA. In this set, there are very few unit trusts with consistent performance over 4%. The best performing, First State Bridge, only had a 5.4% p.a. ROI for the past 10 years. I think the risk-reward ratio is not worth it.

Most of the money in the Ordinary Account (OA) will be earning a guaranteed and meagre 2.5% interest rate which barely beats inflation. The first $60,000 in aggregate across your CPF sub accounts also earns an extra 1%.

The first $20,000 in your OA and $40,000 in your Special Account (SA) are NOT investible. (Source: https://www.cpf.gov.sg/Members/Schemes/schemes/optimising-my-cpf/cpf-investment-schemes )

According to https://www.cpf.gov.sg/Assets/members/Documents/CPFISInvestmentProducts.pdf , CPF-OA money can be used to invest in :

- Insurance (e.g. ILPs, Annuities, Endowments)

- Government bonds and T-bills

- Fixed deposits

- I can't be bothered to find out which banks offer this

- "Safe" ETFs with limited choices

- Straits Times Index (SPDR and Nikko)

- SPDR Gold ETF (GLD)

- ABF Singapore Bond Fund (A35)

- Stocks and other ETFs

- listed in SGX mainboard and traded in SGD only

- Unit Trusts with limited choices

- HDB flat

- ...and others

and CPF-SA:

- Insurance (e.g. ILPs, Annuities, Endowments)

- Government bonds and T-bills

- Unit trusts with even more limited choices

At one glance, the CPF Investment Scheme (CPFIS) seems to be designed to lock our money away in the local markets.

100% of the investible amount can be used for Unit Trusts and the 4 "safe" ETFs. However, only 35% of the investible amount can be used for stocks and other ETFs.

I think it is very weird that high-risk Unit Trusts are considered "safe" (as 100% can be invested in them), when other local stocks are not. Perhaps they think unit trusts are actively managed by professionals hence "safe" and yet often they cannot beat the benchmark despite being paid hefty fees.

I think it is very weird that high-risk Unit Trusts are considered "safe" (as 100% can be invested in them), when other local stocks are not. Perhaps they think unit trusts are actively managed by professionals hence "safe" and yet often they cannot beat the benchmark despite being paid hefty fees.

Of course, to beat the 2.5%, I would like to invest in instruments with the highest potential gains. Only equities can yield the highest returns (which come along with the highest risk as well).

We all know about the high management fees of Unit Trusts. In fact, on average, the total expense ratio for many high-performing Unit Trusts is about 1.7% (based on my observation from Fundsupermart's fund selector) which eats into your returns.

Even though there are Unit Trusts with high returns of at least 10% per annum, I want to avoid them due to the high expense ratio.

Unfortunately, the 4 ETFs are not exactly good alternatives since they will probably yield less returns than Unit Trusts even after taking into account the high expenses, based on the ETFs' historical performance.

In summary, constrained by CPF policies and the lack of better alternatives, I have to reluctantly put 65% of the investible amount in Unit Trusts.

I also invest in Unit Trusts using cash ($300 / month) via Maybank as I want to get the 3% p.a. interest rate under its SaveUp programme. Again, I am compelled to do so as I do not have any better way to fulfill the SaveUp programme criteria. Much of the criteria involve taking up loans (i.e. spending more money rather than saving)

How I choose the Unit Trusts to invest in?

Due to their high-cost nature, I'd want to buy those with the highest potential returns (often comes with the highest risk). I use Fundsupermart's fund selector (for free even though I am not its customer), to find funds with the following in mind:

- Consistency: check the 3-yr, 5-yr and 10-yr returns for consistency. I generally ignore funds with very high 1 or 3-yr returns but low 10-yr return.

- Underlying portfolio: look at the equity holdings to ensure the fund is investing in trustworthy and high-growth companies preferably ones which control a large market share of their respective industries.

- avoid those so-called "high-yield bonds" as those are usually non-investment-grade bonds. I think only our CPF-SA is an exception.

- Fees: check that there is no redemption charge so you can sell without any sale charge.

- There is a risk that the redemption charge may change anytime at the fund manager's discretion.

Many people lost money because they entered at the wrong time, chose the wrong funds or their so-called advisors recommended the wrong funds (usually to line their pockets).

I wonder why there are people buying crappy funds that have been going sideways for years. Such funds still exist today probably because many people are gullible, not financial savvy, and/or they lack the courage to sell to realise their losses.

I wonder why there are people buying crappy funds that have been going sideways for years. Such funds still exist today probably because many people are gullible, not financial savvy, and/or they lack the courage to sell to realise their losses.

Regular Savings Plan?

Many platforms offer some form of regular investment plan that I have since terminated and will avoid for now as I prefer to have more control over the price to buy and sell at (not 100% control though).

Downside

The biggest disadvantages of unit trusts are they don't offer limit orders and the settlement is extremely slow compared to instantaneous buying and selling over exchanges.

Avoiding more fees

I use POEMS as there is no sale charge, no platform fee and no switching cost. It is also a CPFIS administrator meaning you won't incur the $2 / counter / quarter fee from the CPFIS agent bank. FSMOne is also a good alternative with a better user interface and same offering as POEMS.

CPF-SA

I do not invest the SA money as I consider it a 30-year almost-risk-free high-yield "bond". The only risk comes from any CPF policy changes and economy instability.

Anyway there's nothing good to invest in. The only way to beat a guaranteed 4% is to buy unit trusts as CPF-SA cannot be used for stocks and ETFs. There is a limited set of unit trusts for CPF-SA that is different from that for CPF-OA. In this set, there are very few unit trusts with consistent performance over 4%. The best performing, First State Bridge, only had a 5.4% p.a. ROI for the past 10 years. I think the risk-reward ratio is not worth it.

Thursday, January 25, 2018

Stock and Unit Trusts Big Gains and some Thoughts 25 Jan 2018

Have been busy and will only post my update on unit trusts bought using CPF OA funds.

If they can successfully motivate the market and institutions to buy then I think it would be wise to follow along.

Aberdeen Thailand Eq Fund

|

5,200.00

|

5,750.26

|

550.26

|

10.58%

|

First State Regional China Fund

|

9,600.00

|

10,599.19

|

999.19

|

10.41%

|

PineBridgeIF - Singapore Bond Fund

|

1,400.00

|

1,406.57

|

6.57

|

0.47%

|

The equity markets are doing well globally for developed and developing economies. Recently I bought another 5k of the First State Regional China fund. The bond market on the other hand is lacklustre as I presume investors have been dumping bonds to ride the wild bull.

I will pump in more when the prices dip (should be soon as they have been rising for some time).

The XIRR for the equity fund should be 15-20% as I first started buying the funds about 6 months ago.

I have been buying small amounts in order not to miss the bull gains and also due to caution as nobody knows when exactly the correction will happen this year.

I have been saving up for a warchest for the correction.

Stocks bought with Cash

I have also sold Venture (V03) a few days ago making a nett profit of $471. (about $4340 -> $4811). ~11% ROI in just a several weeks.

Transaction was made on Poems as I thought I had a prepaid account with lower fees but actually I had a custodian account. Total fees were > $50, totally not worth it considering the small amount I invested.

My other stocks such as DBS, ST Engin and STI are doing well in the bull run. Seems nothing can stop them near-term. Even Sembcorp Ind is picking up after a lacklustre 2017.

Bank analysts as market influencers

I have been looking at bank analysts reports which tell you to buy, sell, or hold on to certain stocks.

I presume they are somewhat accurate as some of the stocks they recommended to buy have good fundamentals.

If they can successfully motivate the market and institutions to buy then I think it would be wise to follow along.

Their underlying incentive is probably to:

1. influence market interest to align with their own interest (e.g. they lent $ to the company or they themselves bought the stock)

2. influence wealthy clients to buy and thus suck their $ as comm fee.

3. generate interest on their own broker services.

Subscribe to:

Comments (Atom)

-

Nowadays you can't avoid seeing the word "AI". AI is everywhere. Every company is rapidly adopting AI. Google today just relea...

-

Previously, I mentioned that there is some euphoria/FOMO (Fear of Missing Out) in the market. Look at meme stocks like PLTR, HOOD, etc. and...

-

As mentioned in my earlier posts, July 9 will determine the "final outcome" as the 90-day pause ends. My prediction as I have men...

AI is real and so is the bubble

Nowadays you can't avoid seeing the word "AI". AI is everywhere. Every company is rapidly adopting AI. Google today just relea...